Blog

Gold Investment Options in India.

Article by Mr.Krishna kumar (Chief Financial Officer, Chungath jewellery)

Today, gold as an investment is just not limited to buying ornaments or jewellery, it has expanded into many different options. One can invest in gold through various other means like Gold ETFs, Gold Mutual Funds, E-Gold, etc., with each holding unique benefits. Investors wanting to invest in gold, here’s a guide on different Gold Investment options in India.

Top Gold Investment Options in India

Here are some of the best investment options under Gold:

• Gold ETF

• E-Gold

• Gold Schemes - Gold Monetisation Scheme, Gold Sovereign Bond Scheme & Indian Gold Coin Scheme

• Gold Mutual Fund

• Gold Coins and bullion

1. Invest in Gold Via Gold ETFs

Gold (ETFs) Exchange Traded Funds are units representing physical gold, which may be in dematerialised form or paper form. These are open-ended funds that trade on major stock exchanges. Investors can Buy Gold ETFs online and keep it in their Demat account. Here one gold ETF unit is equal to one gram of gold.

Benefits : One of the major advantages of Investing in Gold ETFs is that it is cost efficient. There is no premium like making charges attached to it. One can buy at the international rate without any markup. Furthermore, unlike physical gold, there is no wealth tax on Gold ETFs in India.

2. E-Gold- Buy Gold in Electronic Form One of the other gold investment options in India is e-gold.

To invest here, one should have a Trading Account with specified National Spot Exchange (NSE) dealers. E-gold units can be bought and sold through the exchange (NSE) just like shares. Here one unit of e-gold is equal to one gram of gold.

Benefits : Investors wanting to make a long-term investment can buy e-gold in small quantities and keep it in their Demat account. Later, after achieving the target, they can take the physical delivery of gold or can encash the electronic units. Also, the transparency in pricing and seamless trading is one of the major benefits of this product.

3. Invest in Three New Gold Schemes

The Government of India has recently launched three gold-related schemes, namely- the Gold Monetisation Scheme, Gold Sovereign Bond Scheme and the Indian Gold Coin Scheme.

Gold Monetisation Scheme

The Gold Monetisation Scheme (GMS) works like a gold Savings Account, which will earn interest on the gold that you deposit, based on the weight along with the appreciation in the value of gold. Investors can deposit gold in any physical form- bar, coins or jewellery.

Investors would earn regular interest on their idle gold, which not only encourages gold investment but also adds value to savings too. The deposit term of this scheme i.e.,- Short-term, mid and long term- allows investors to achieve their Financial goals.

Sovereign Gold Bond

The Sovereign Gold Bond scheme is an alternative to purchasing physical gold. When people invest in gold Bonds, they get a paper against their investment. Upon maturity, investors can redeem these bonds to cash or can sell it on Bombay Stock Exchange (BSE) at the prevailing Market price.

Sovereign Gold Bonds are available in the digital & Demat form and can also be used as Collateral for loans. Minimum investment under this scheme is 1 gram.

Indian Gold Coin

The Indian Gold Coin Scheme is one of the three gold investment options launched by the Government of India. The coin is currently available in denominations of 5gm, 10gm & 20gm, which allows even those with a small appetite to buy gold. The Indian Gold Coin is the first national gold coin which will have the face of Mahatma Gandhi on one side and the image of Ashok Chakra minted on the other side. One of the most advantageous features of this scheme is the ‘Buy Back’ option that it provides. Metals and Minerals Trading Corporation of India (MMTC) offers the transparent ‘buy back’ option for these gold coins through its own showrooms across India.

4. Gold Mutual Funds as a Gold Investment Option

Gold Mutual Funds are schemes that mainly invest in gold ETFs and other related assets. Gold Mutual Funds do not directly invest in physical gold, but take the same position indirectly by Investing in Gold ETFs.

Benefits: To invest in Gold MF, investors don’t need a Demat account. Also, here you are not constrained to buy complete units, unlike in an Exchange Traded Fund. So if you have INR 2000 to invest in gold you can buy units in a Gold Mutual Funds but it would be insufficient for a unit of gold in an ETF. You have the option of systematic investment too, so you can buy for as little as INR 500 p.m. SIPs are a good way to accumulate gold as an investment.

5. Gold Coins and Bullion

Buying gold in the form of bullion, bars or coins is generally considered to be one of the popular gold investment options, especially for those who want to buy physical gold. Since gold bars and bullion are made with a purest physical form of gold, investors are more inclined towards Investing in gold in this form.

Benefits: The benefit of gold bullion is that it is easily recognizable and easy to find buyers.

Article by Mr.Krishna kumar (Chief Financial Officer, Chungath jewellery)

916 Gold Rate during year 2022

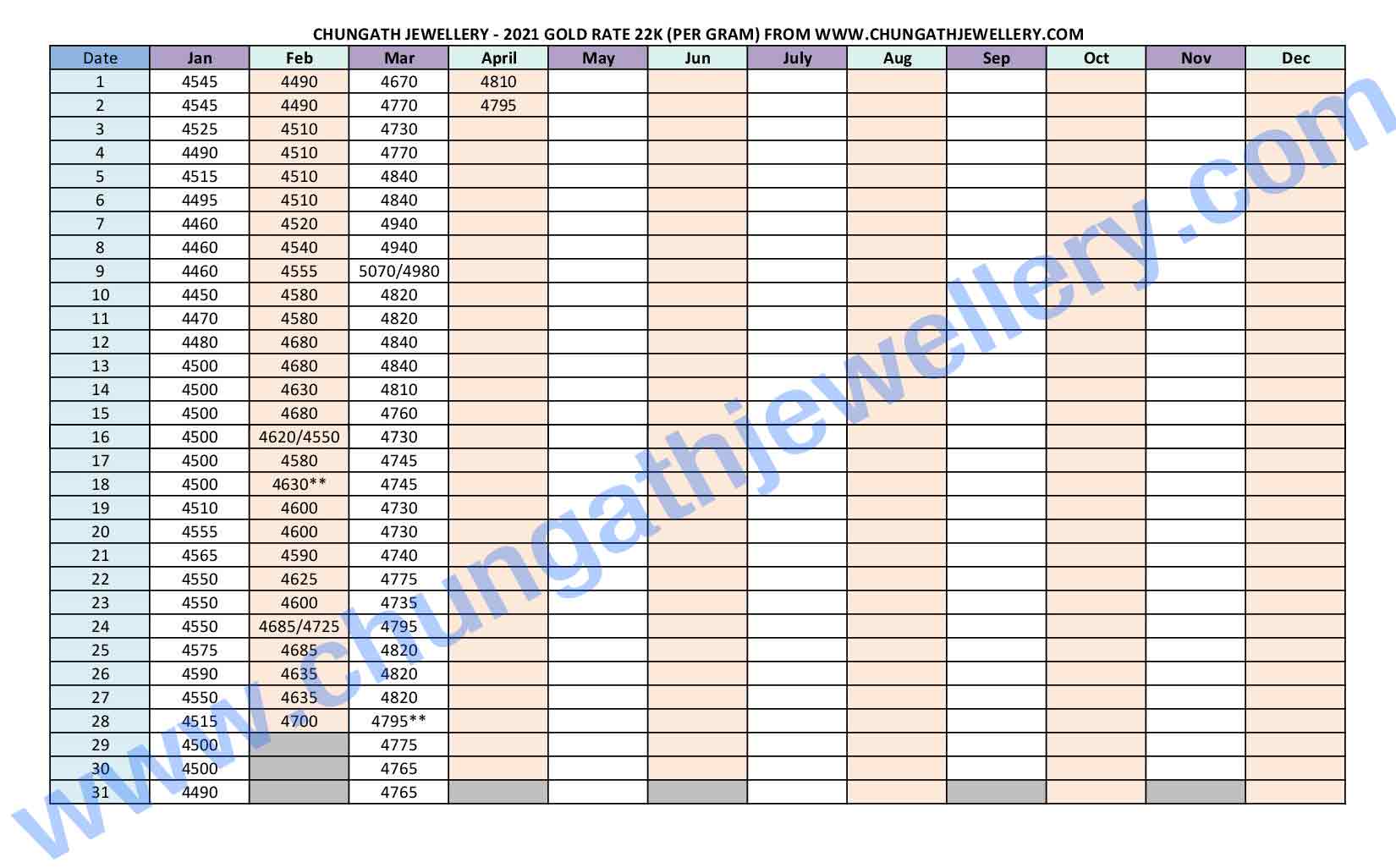

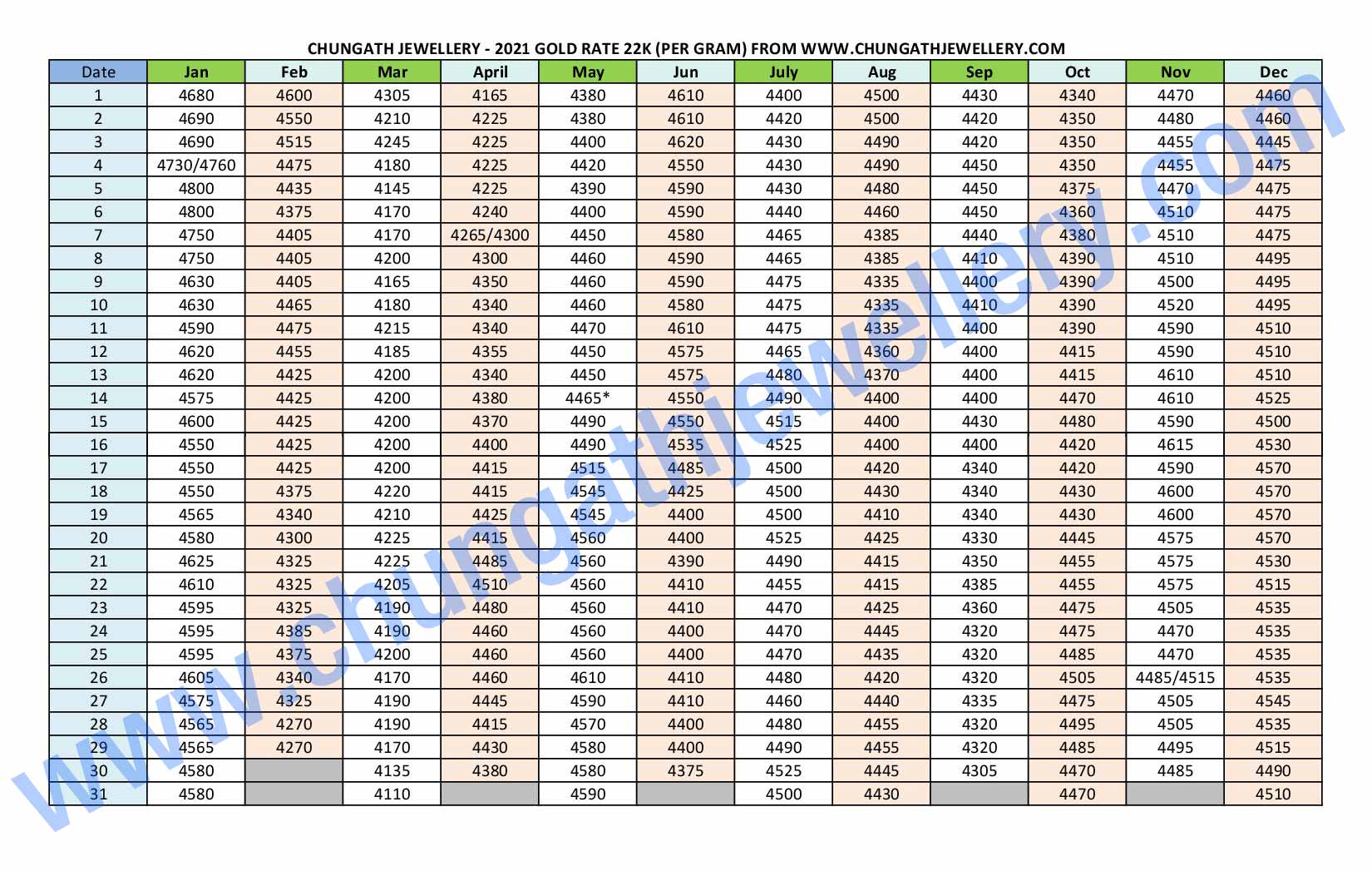

916 Gold Rate during year 2021

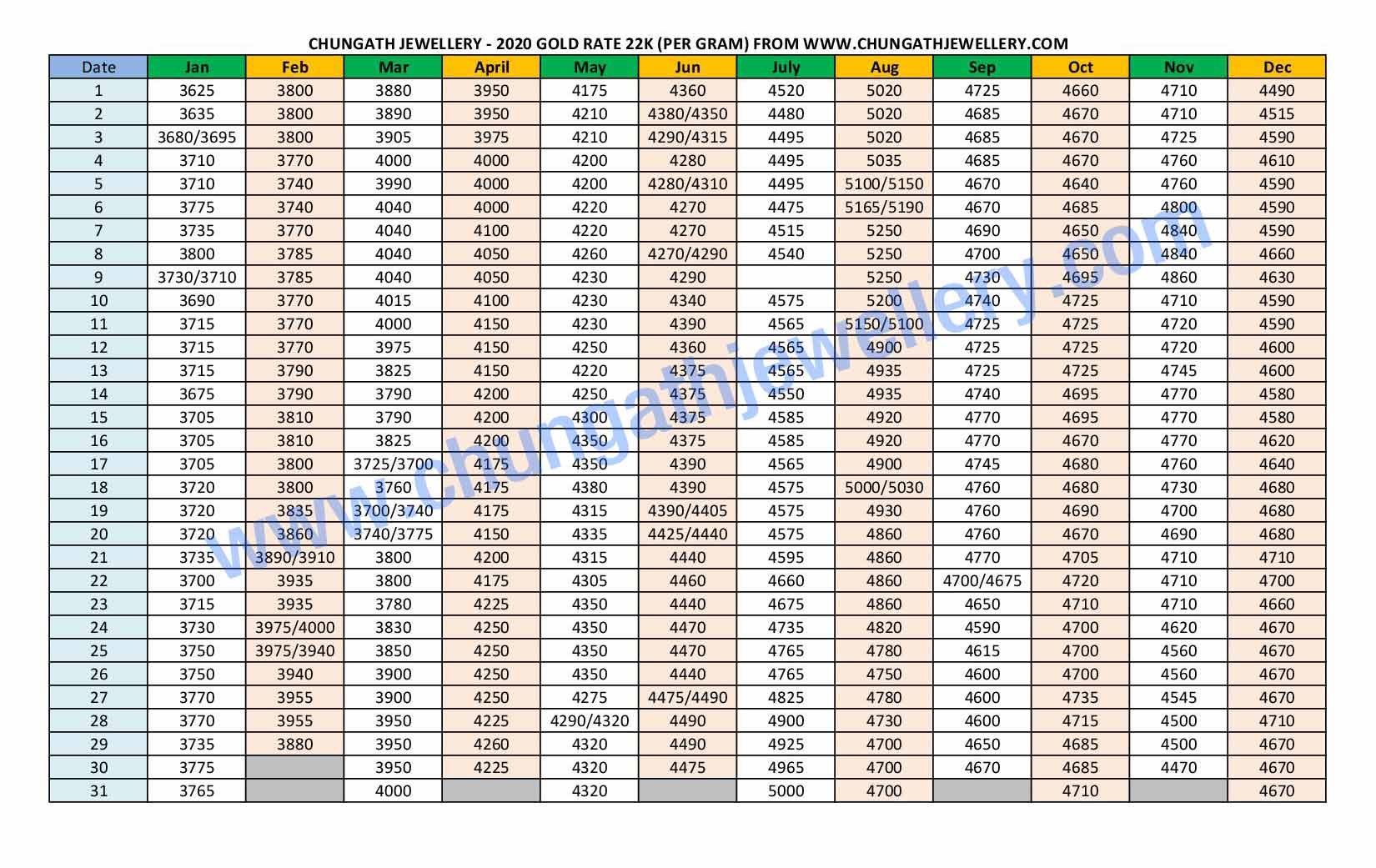

916 Gold Rate during year 2020

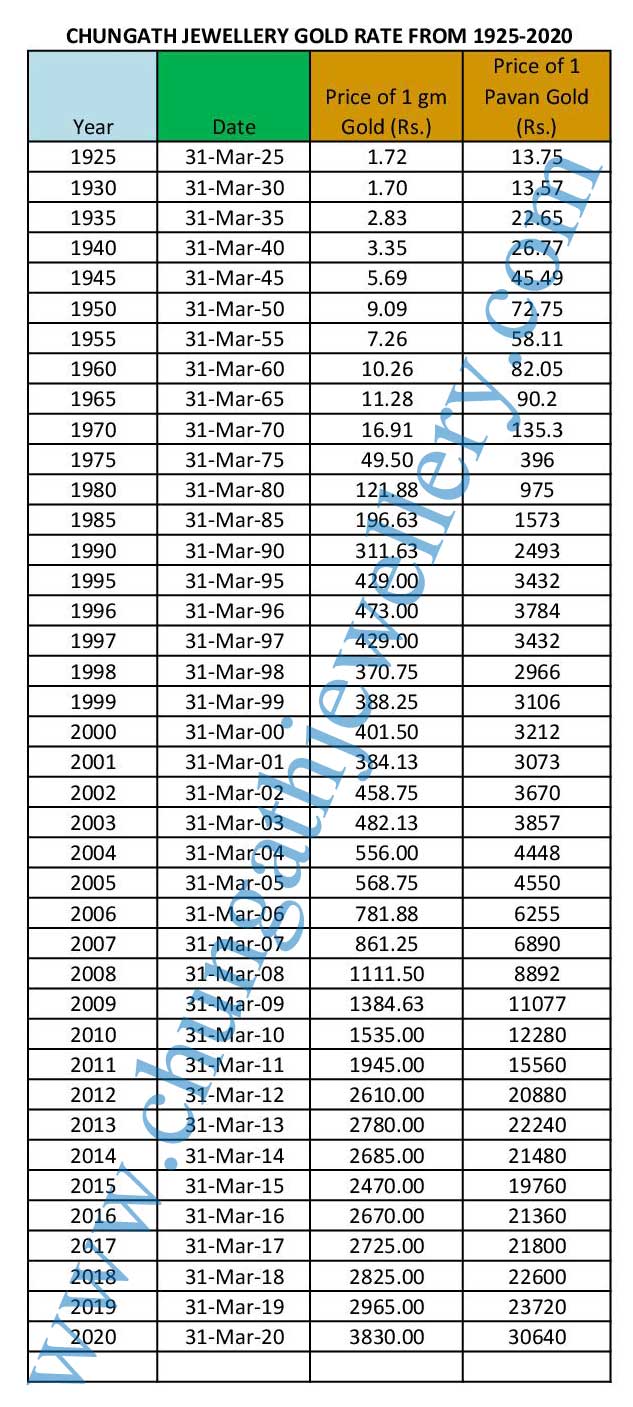

916 Gold Rate year 1925 to 2020

Trivandrum Anniversary Offer - Article in Asianet News

Interview with Chungath Jewellery Managing Director, Mr.Rajive Paul